|

|

|

|---|

|

|

|

|---|---|---|

|

|

|

|

|

|

|---|---|---|

|

|

|

|

Does Chapter 13 Bankruptcy Work: Key Features and Insights

Chapter 13 bankruptcy is often referred to as a wage earner's plan. It allows individuals with regular income to develop a plan to repay all or part of their debts. But does it really work?

Understanding Chapter 13 Bankruptcy

Chapter 13 bankruptcy involves restructuring your debts to make them more manageable. You will work out a repayment plan with the bankruptcy court, usually lasting three to five years. This approach can be beneficial for those who want to keep their property and have a steady income.

Key Benefits of Chapter 13

- Debt Consolidation: All your debts are consolidated into a single payment.

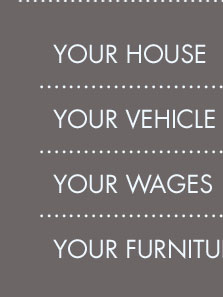

- Asset Protection: You can keep your property, including your home and car.

- Creditor Relief: Creditors must stop collection activities, providing you relief and peace of mind.

If you're considering Chapter 13 bankruptcy, consulting a bankruptcy attorney in Mobile, AL can help you understand your options and obligations.

How the Repayment Plan Works

Under Chapter 13, you propose a repayment plan that details how you will pay back your creditors. This plan must be approved by the court, and you must adhere to it strictly to avoid any complications.

Creating a Feasible Plan

- Income Assessment: Calculate your regular income to determine what you can afford.

- Expense Evaluation: Identify necessary expenses to ensure your plan is realistic.

- Debt Prioritization: Decide which debts are prioritized in the plan.

Working with a knowledgeable bankruptcy attorney in New York can significantly aid in crafting a viable plan that meets both your needs and legal requirements.

Challenges and Considerations

While Chapter 13 bankruptcy offers many benefits, it also comes with challenges. Sticking to a long-term repayment plan requires discipline and can be financially straining.

Possible Pitfalls

- Missing payments can lead to dismissal of your case.

- Unexpected financial setbacks can disrupt your repayment plan.

- Legal fees and administrative costs can add up over time.

Frequently Asked Questions

Can Chapter 13 bankruptcy stop foreclosure?

Yes, Chapter 13 bankruptcy can stop foreclosure proceedings. It allows you to catch up on missed mortgage payments over the life of your repayment plan.

How long does Chapter 13 bankruptcy affect my credit?

Chapter 13 bankruptcy will appear on your credit report for seven years from the filing date. However, its impact diminishes over time as you demonstrate improved financial management.

What debts can be discharged in Chapter 13 bankruptcy?

While Chapter 13 allows for the discharge of certain debts, like unsecured debts, it does not typically discharge secured debts or priority obligations such as alimony, child support, and certain taxes.

In conclusion, Chapter 13 bankruptcy can be an effective tool for those looking to manage their debts while retaining their assets. Careful planning and adherence to the repayment plan are crucial for success.

As long as you don't accrue more debt and you make your payments and live within the budget, you will survive in the end.

Only then may a court eliminate some of your remaining debt if you meet specific requirements. WHAT IS CHAPTER 13 BANKRUPTCY? The average person ...

If you did not know this already, the bankruptcy laws in the United States were written by lobbyists working on behalf of lenders and ...

![]()